Professor Peter Quartey, the Head of Economic Division at the Institute for Statistical, Social and Economic Research on Tuesday called on the Bank of Ghana to regulate the Foreign Currency Black-market Transactions.

He said the measure would ensure that anybody, who transacted business through exchange of currency, leaves records for the Bank to track and know how much the country was getting out of the system.

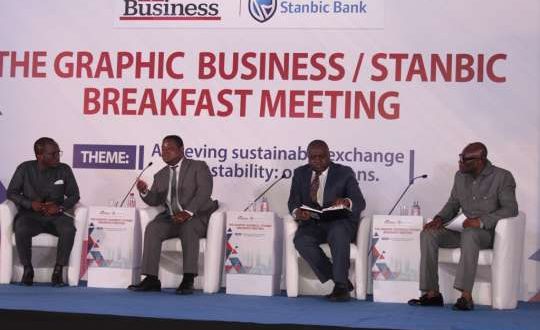

Prof. Quartey was speaking at this year’s edition of the Graphic Business/Stanbic Bank Breakfast Meeting in Accra on the theme: “Achieving Sustainable Exchange Rate Stability: Our Options.”

The quarterly meeting is to help stimulate intellectual discourse on pertinent issues affecting the national development.

He said: “At the moment, I do not think we are effectively doing anything in that regard to regulate them”.

On the depreciation of the cedi, Prof Quartey said, the Bank of Ghana needed to strengthen the macroeconomic fundamentals like the real Gross Domestic Product growth, fiscal deficit, inflation and debt.

He said, “an effective management of short-term spikes and slippers was important with sustained efforts to address medium to long-term structural bottlenecks to the real sector”.

He also suggested the facilitation of transactional trade between Ghana and China through the Central Banks describing it as important.

Dr Ernest Addison, the Governor of the Bank of Ghana, said the country had chosen a flexible exchange regime and this had helped in terms of growth performance over the years.

He said there was the need to improve the local contents in some of the leading sectors of the economy such as oil and the gold mining sectors in order to advance the performance of the currency.

He said the strong policy reforms in the last 24 months was a complimentary monetary policy coupled with financial sector reforms was yielding expected results adding that, “those were issues of the fundamentals of the country’s economy”.

He said for the country to deal with the bias against the cedi, there was the need to deliberately increase export and reduce import of goods to ensure the sustainable stability of the currency.

He said: “So long as we remain import dependent, we would have a bias of the currency in losing its value over time.”

The Governor said there was the need for the inclusion of micro and macroeconomics factors, when running the fiscal and monetary policies, which also had an impact on the behaviour of the exchange rates.

He said although it was important to be a recipient of sovereign bonds, they should be used to finance capital projects than being used to finance current expenditure.

Dr Joseph Obeng, the President of the Ghana Union of Traders Association (GUTA), said the Union had initiated the “income in income out” policy to help boost export.

He said the depreciation of the cedi negatively impacted businesses in the country as it reduces profit margins, adding that, “Increase in export is the surest way out”.

Dr Obeng said the depreciation does not encourage the stabilisation of prices, making it difficult for the Ghanaian trader to lose out of competition in the market.

Source: GNA

Public Agenda NewsPaper Ghana's only Advocacy & Development Newspaper

Public Agenda NewsPaper Ghana's only Advocacy & Development Newspaper